હેલ્થ ઇન્શુરન્સ કેવી રીતે પસંદ કરશો ? | How to Choose Health Insurance Know in Gujarati @ policybazar.com

How to choose the best health insurance plan for you? That question always comes to your mind before taking out a policy. Do you have this question in your mind? So watch this video from the policy market to know more about some of the important points to consider when choosing health insurance.

Before purchasing a Health Insurance / Mediclaim policy, compare it on PolicyBazar.com and then select. Learn more about health insurance

વિડીયો જુઓ 👇👇👇

Family Health Insurance: A Comprehensive Understanding

The often seen family health insurance is one of the best ways to protect your family from an unexpected health care crisis. Some family is the most important part of our life and we all want to keep our family members safe. How does one do this? Getting a family health plan (or medical plan for the family) is easy. Various health insurance policies for family are available in the market. It is advisable to compare the health insurance quotes offered by different health insurance companies and choose the cheapest family health insurance at the same time without compromising on the features.

● APPLY ONLINE FOR COVID-19 સહાય

● કોરોના સહાય 50000 ફોર્મ : ડાઉનલોડ કરવા અહીં ક્લિક કરો

📍 ૧૦ દિવસમાં સહાય ચૂકવવા બાબત

● કોવિડ સહાય ફોર્મ અહીંથી ડાઉનલોડ કરો

● કોરોના થી મૃત્યુ પામેલ ને 50000 વળતર બાબતે તા 20/11/2021 નો પરિપત્ર

💥 કોરોના સહાય માટે ઓનલાઇન અરજી

family health insurance

Family Medical Insurance Nowadays, family insurance is essential for everyone as there are drastic changes in the lifestyle of the people. Also, nowadays, medical insurance policies are easily available online as well as offline. But, first of all, the most important thing to know is how is family health insurance different from an individual health insurance policy? let's find out!

family health insurance

A family health insurance plan is a health insurance plan specially designed for families. Basically, it is similar to an individual health insurance policy, with the only difference being that a family health plan covers the entire family. Here is an example to make it easier for you.

Suppose you are a 45 year old salaried employee and your family consists of four members including two children. To keep your family safe, you pay Rs. Buy personal medical insurance worth Rs 3 lakh. Thereafter, if your child is diagnosed with a critical illness and the total health care cost is Rs. 4 lakhs, you have to pay the remaining Rs. One lakh rupees will have to be given from his own pocket. Conversely, if you pay Rs. Buy a family health policy for Rs 5 lakh and in such a situation you get the full amount coverage and you do not have to pay any extra.

Hence, it is advisable for everyone with family responsibilities to buy a family health plan. Buying health insurance for a family is not only expensive but also guarantees health coverage. However, there are some tips to consider before you start looking for medical insurance plans. just have a look!

Tips for Buying a Family Health Plan

Research the best family insurance plans

Health insurance companies in India offer a wide range of family health plans. Choosing the best among them is really a difficult task. But to make sure you're buying the right family health insurance, do your full research and explore all of the best options available before narrowing down your options.

Analyze your family's health care needs.

This is an essential factor that we must consider. Each of us has unique health needs. In general, different health insurance policies for family have different health quotes and features. Some plans may be uncomfortable at first glance because of their bountiful benefits, but it is important for you to make sure that you really need those benefits, even if they are right for you. Therefore, always choose family insurance that best suits the needs of you and your family.

Determine the amount of health quotes and the amount of money wisely

When it comes to choosing family health insurance, the most important thing to decide is the amount of money. The amount covered by your family under a family health insurance policy is a guaranteed amount. Hence, it is important to choose the amount wisely as you will be insured up to the selected limit. To ensure the best value for money, one should take quotes from various insurance companies.

best health insurance plan for family

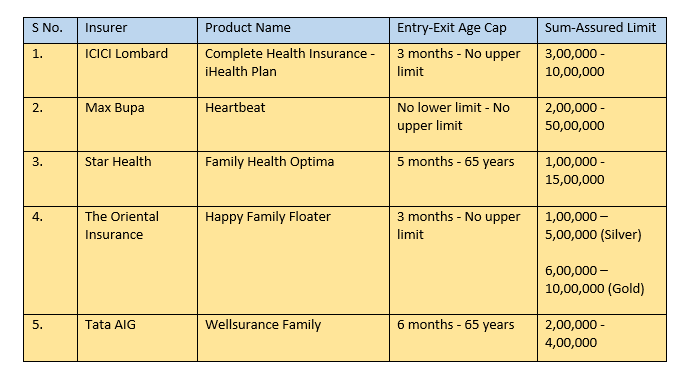

With an aim to protect your family from health related problems, if you are thinking of buying a family health insurance plan, here are some of the best health insurance plans for family that you must check out.

1. ICICI Lombard Complete Health Insurance - iHealth Plan

2. Max Bupa Heartbeat

3. Star Health Family TI

4. Oriental Insurance Happy Family Floater

5. Tata AIG Valuation Family.

Read in Gujarati

If you're not sure which health insurance plan to buy, check out the ET Wealth Wealth-PlanCover.com rankings. In this issue we have featured top options for single people above 60 years of age. With the rising cost of health care and medical treatment, insurance coverage has become very important to you. The market is booming with a variety of products, with more than 6 companies operating in general insurance and many life insurance companies offering different types and sizes of shields. Its characteristics, terms, limitations and sub-limits are often hidden in the fine print and its interpretation is confusing.

This makes it difficult to choose a product that is suitable for a certain age and gives full value for money paid. Most decisions are made on the basis of low cost, claim rate or recommendation made by the agent. This may result in rejection or even partial settlement of the claim. To reduce this concern, we provide a ranking of various health insurance products available in the market. PlanCover.com, HII Insurance Broking Services Pvt. Ltd. Is an insurance broker licensed by IRDA and ranked by. It tries to explain the implications of the various terms and conditions mentioned in the policy and helps you come up with the most suitable policy for you. Instead of pointing to the policy segment or feature individually, plancover.com links it to the customer category. Various features of the policy are weighted according to their relevance to the consumer segment and then a final ranking is given. ET Wealth will make this ranking available every other week for different consumer segments.

The listing will be accompanied by a star rating, premium rates and five features that are most relevant to the category concerned. Details will be found in the given link. We hope this eliminates the hassle of choosing an insurance policy and meeting your specific needs. Thus while planning for healthImportant aspects in insurance It is important to look at the ranking of insurance companies and their products. Before choosing a plan from this ranking, we should also look at our needs. No health product should be selected on the basis of ranking alone.

Important aspects of insurance

Critical Illness – This includes the room rent limit or the ceiling for various treatments. If not then here's a new product just for you!

Motivation The key aspect of this characteristic is that it is less likely to occur, but it is associated with a higher cost. This is for the family floater. The word very unlikely has been used in this.

General Provisions – This facility is associated with high probability, but costs less than health care, and covers all aspects as per IRDA guidelines.

Luxury – such features do not include the impact of high cost and low probability of occurrence.